For designers already sick of explaining to clients why their furniture is taking forever, here’s a fun new one: Your sofa might be sitting at the bottom of the ocean.

Last weekend, a California-bound cargo ship hit a patch of rough weather, and 750 containers were lost at sea. According to American Shipper, which covers the global supply chain and international transportation, the vessel—which is now being rerouted to Mexico so the damages can be assessed—was carrying more than 4,000 containers of furniture cargo, including goods from Amazon, Ikea and Williams-Sonoma. Such is the strange interconnected world of globalized logistics that rising barometric pressure over the Pacific Ocean can lead to an empty living room in Dayton, Ohio.

Of course, these days, most furniture is delayed for another reason entirely. It’s no secret that lead times are stretching ever longer as COVID drags on—and that many clients are getting impatient. The delays have cut across categories, from bespoke upholstery to tile and kitchen appliances; even many of the quick-ship retailers can no longer deliver on tight timelines.

Shutdowns of the manufacturing floor with the onset of COVID instigated an initial round of delays, which were compounded by a slow return to production as companies navigated new safety protocols. More than one year later, many major manufacturers still aren’t staffed at full pre-pandemic capacity, which makes it much harder to catch up on the backlog. And every time an employee tests positive for COVID, many more workers with whom they came into contact are sent home to quarantine, which only exacerbates the delays. Add soaring freight costs and a scarcity of raw materials (plus a shortage of containers to ship them in) and it quickly becomes clear that this is a mess with no easy answers or antidotes.

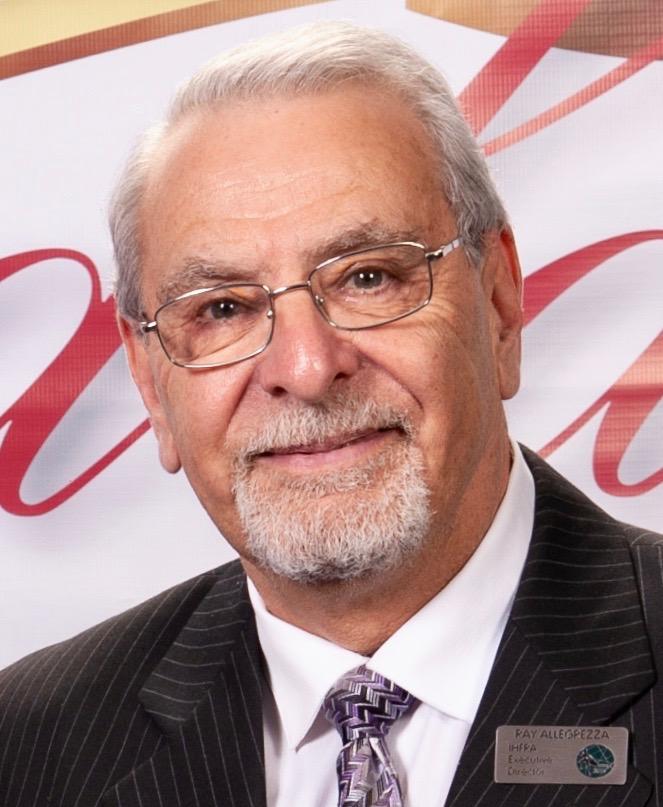

What’s a designer to do—and is there an end in sight? BOH called up Ray Allegrezza, the executive director of the International Home Furnishings Representatives Association (founded in 1934 to focus on the needs of the industry’s sales reps) and former Furniture Today editor in chief, to get a read on the current manufacturing climate. Allegrezza explains how the cracks in the furniture industry’s foundation finally gave way and offers his frank assessment about when the tide will begin to turn.

Let’s take a quick look back. In your eyes, what’s the fallout from 2020 in the home furnishings industry?

I wrote a column in December that said, “I can almost hear the audible sigh of relief as we shut the books on this year.” But you know what? The storm continues. I don’t think we’re going to be out of the woods until maybe the third quarter of 2021. This stuff is not going to mitigate—the supply chain is not going to bounce back.

What are the biggest hurdles in those recovery efforts?

The biggest thing right now is container prices. I’ve been talking to a lot of my manufacturer friends, and they’re saying that a year ago, they were paying $2,300 or $2,500 for a container. Now, if they can get on the list, it’s $7,500.

That’s if they can get on the list.

And they’re saying they can’t get on the list! The big guys like Ashley and Man Wah can call in favors—it’s like anything else, where if you do a lot of business with somebody, you can say, “You need to bump me up a little bit on the line,” and they’re getting it. But, by and large, it’s a mess. It’s a logistics nightmare out there.

How much of what you’re seeing is actually a new problem?

Throughout the 30 years I’ve been in the industry, I’ve always felt that our most critical link, the logistics aspect of our business, is really our weakest link—with the exception of maybe Ashley and a couple other big guys that figured it out.

It’s such a precarious way to run a business, to just hope that things go well. I know supply chain is an issue in every industry—we read about that this holiday season—but in the furniture business, the whole thing always struck me as comical. Here we are bringing dealers to upwards of six or more markets a year and enticing them to buy new furniture. Those dealers then have to wait three or four months to get it—and they are fine with it because they aren’t logistically set up to move merchandise on and off the floor in a timely manner.

In the 1980s, [City Furniture CEO] Keith Koenig told me, “We’re not really in the furniture business, we just move boxes. We’re in the logistics business, and the boxes happen to contain furniture.” He got it decades ago. A lot of the small- to mid-sized dealers understand the importance of logistics, but they’re so busy running the business that they never really have time—or don’t invest the time—to make the businesses more efficient.

What are the big changes that you see dealers needing to make?

They need a brick-and-click position. They need to look at e-commerce not as the enemy, but as an alternate source of income. That doesn’t mean that you have to try to be Amazon Lite. You can explain to your customer why you chose not to do the Wayfair model, but you’ve got to be able to say, “Here’s what’s special about our model.” And you’ve got to have something to back it up.

I also think the messaging has to change. If your deal [to attract customers] is that there’s no down payment or interest for 60 months—[it sends a message that] this product can’t be too good or valuable, or you wouldn’t be able to get away with that. If it was truly valuable, you’d think that you’d have to have some skin in the game to take it home. But I guess I’m dreaming, because we already have some big players that do that consistently.

On the manufacturer side, obviously there are more orders than can be fulfilled right now, but is it really just that there are more orders than usual, or are there some other things that have broken down in the process?

Well, the orders seriously have spiked. I’ve had reps tell me that this year was their best year ever, despite COVID. On paper. Now, they get paid when the furniture is delivered, so they’re going to be fat and happy once the furniture delivers and they get their product.

So, July.

Exactly—I hope they can hold out and pay their bills until then. I think there are going to be some residual hangovers in 2021 that we still have to figure out how to mitigate. I think it’s going to take maybe two quarters to work itself out.

One of the things that manufacturers have struggled with is transportation and logistics—always a nightmare. Almost every time there’s a shortage of containers, the prices go up and the delivery times mirror that, as well. Whenever this happens, the factory is not happy, the customer is not happy, and the retailer is certainly not happy. The other thing manufacturers continue to be plagued with is the increasing cost of raw materials. For example, I know a large upholstery maker out in China that just got put on allocation for foam, [which means they’re on a waiting list to buy goods from their supplier]. That’s a primary element in your product, and it’s not like they can go and say, “Oh, I’ll pay $5 more somewhere else.” There’s just nothing available. Your raw material prices have gone through the roof. Steel, foam, springs, even fabric—you can’t get containers to ship it.

Is the progress China has made in containing the pandemic a good sign?

Well, when COVID hit in China and the workforce there got sick and stopped working, it was terrible. But now, you know what’s coming up in February? The Chinese New Year. When I would go over there and talk to the factory owners, they lived in fear of Chinese New Year. The bulk of their workers come from farming communities, where the living conditions are more challenging, so they are thrilled to work at the factories—they work like crazy, save every penny, send three-quarters of their salaries home each paycheck, and when the factory closes for two weeks for Chinese New Year, they go back to visit Mom and Dad. With the money they have saved, many decide to stay at home and start cottage businesses. It’s amazing to see that kind of entrepreneurship, but it’s bad for the factories, and it happens year after year after year. It’s predictable.

So the factories there are all starting over, in some respects, when they come back online.

Exactly. There’s a training process. You can’t replace a trained finisher or upholsterer with someone who’s just come from the farm and expect them to be knocking out pieces with the same competency as the guy that’s just left after working for a year or two. This is what I mean about disruption in the supply chain—and a lot of this, the consumers never realize it’s there. But if you have breaches in the workforce every year, rising raw material costs and scarcity of raw material, lack of containers, and—like they say on late-night TV—“but wait, there’s more!”

The political climate?

Trump, before he left office, started an investigation in Vietnam of two critical things. One of them is currency manipulation, so the government is taking a hard look at that. But what could be more detrimental [for the furniture industry] is that the government has initiated an investigation claiming that there may not be the proper chain of custody for lumber coming from Vietnam.

Is there a precedent for that?

When the same thing happened a couple of years ago in China, manufacturers like Ashley, Man Wah—everybody and their mom that had money—opened up new factories in Vietnam. Now, the wood from Vietnam is suspect and sitting on the dock. I feel like I need a black hood on. I feel like the executioner, but I’m just being a realist!

Do you think companies will pick up and move to another place again, or do they wait this one out? What’s the opportunity cost there?

It depends on how heavily invested [they are] and how much of their capacity is coming from that factory. There has even been talk, people say, “Gee, maybe we should take a look at Mexico.” Some people are taking a look at India. But you know what? Eventually, the problems follow. They all follow.

Years ago, before all the production was in China, the bulk of the production was in High Point and the Virginia area, with Bassett and Vaughan-Bassett. And before that, there was a ton of production in Grand Rapids, Michigan—they used to be called the Michigan Mafia. You know what? You follow the labor. Wherever the labor costs are lowest, these guys go berserk, abandon where they are and run to their new, low-cost provider. It may be that down the line they move back to Mexico because of the proximity, or to India—gosh only knows.

Things like rising raw materials and container costs—are those price hikes directly linked to COVID or was that already brewing?

If you check the history of container pricing, it always goes up and down. It was always predicated on supply and demand. And the carriers are smart: When demand was up, so were the prices. But with the onset of COVID, everything just stopped and then things got backed up. The container prices were creeping up anyway, but not anywhere near the egregious amounts that they are now—I mean, $7,500 from $2,500 a year ago?

And with raw materials, is that the same, with everyone playing catch-up?

Yeah. I hear from some of the big upholstery guys that allocation for foam or steel springs and metal has gone up 20 to 25 percent. And the retailers always do the same thing—this industry has created a monster with the retailers, and I’ll tell you why. For years and years, the larger retailers have been catered to: “Come to High Point, we’ll pay you. We’ll put you up at a nice hotel, feed you delicious meals and serve you really good wine, because we want you here.” Or, “Come to Vegas. We’ll pay to fly you out and comp your room.”

If this became normal for you, and then somebody says, “Oh, by the way, this time, this one’s on you,” of course, retail went ballistic! I think we’ve created a generation of retailers—and it goes back even further than this generation—where to keep them happy, manufacturers wined and dined them, took them to shows. There was one guy, a buyer for a top 100 retailer, and his nickname among the suppliers was “Buy-Me-Dinner Dave.” Before this buyer would go to dinner with you, he would tell you where you were taking him and say, “I pick the wine,” and always pick the most expensive one.

Honestly, I understand that’s how the world turns, but to me—I went to Woodstock, so in my mind, I’m still a young hippie—that really shouldn’t play into it, but it does. Which is a long way of saying that these retailers know that costs have skyrocketed due to COVID. Their own costs have skyrocketed, but they play this straight face and go, “Nope, I’m not going to take the price increase.” They think that they have their game face on dramatically enough that they’ll win, but it hasn’t been the case. They’ve had to absorb some of the price increases.

Do manufacturers need those retailers in the same way, or is that relationship changing?

An interesting thing happened during COVID, and it’s going to be curious to see what happens when everything blows over. A certain upholstery manufacturer among the top 25 sent out letters to thousands of their secondary and tertiary accounts, and said, “Love you, mean it, but if you can’t place an opening order of whatever amount, go someplace else.” And we saw that more than once. A lot of the small guys, the floor retailers, I really wonder what their future is.

But as far as whether the manufacturers still need the retailers, I say yes. Most of these guys, probably 30 to 35 percent of their dealer base does 70 percent of their volume, and they’ve got to keep them happy. It used to be about 80/20, but I think it’s changed. But I also think that we may see some musical chairs when the smoke clears.

I’ve heard that, too—that High Point manufacturers are getting way more calls from potential partners who are interested in switching manufacturers.

Bingo. Yes.

Except I’m not sure one’s a better deal than anyone else, really, right now.

Right, everybody’s in the same boat—in the sense that now, nobody’s got product. He or she with the product wins. It’s starting to get better—brands are starting to come back online, but they’re not nearly where they were before.

I think the thing that scared the snot out of so many people is when Ashley hiccuped. Ashley never hiccups. Ashley is God. Forget Clapton is God, [Ashley Furniture Industries founder and chairman] Ron Wanek is God. But guess what? Nobody’s God in this COVID [climate]. They say that the fence is only as strong as its weakest point, and there are some very weak links now in the supply chain, so I would say keep your eye on the supply chain and on possible tariffs from Vietnam—both the currency and chain of custody for work—because that could slow things down again.

When we do all have product again, how will the landscape be different?

This is more anecdotal, but I feel really strongly that being forced to stay at home and buy so much stuff online, people have purchased brands that they’ve never considered before—and they found that they liked them! That’s not going to rock the boat overnight, but I think it’s going to have a residual effect.

In terms of them being willing to try buying new things online, or in terms of new brand loyalties?

Both. And circling back, this is why the brick-and-mortar guys really have to up their game, because the consumers out there have money and are going to come back into the fray. A lot of retailers, even when they switched to appointments only, were like, “Oh, my God, we’ve never been this busy.” But nothing lasts forever. Consumers are fickle, and they’re all only looking for the next hot thing. So if my website or store looks lukewarm, why do I think I’m going to be in business five years from now?

Let’s talk about domestic freight and trucking. Has that been another hurdle?

Those of us in the furniture industry are experiencing the perfect storm. The challenge is a shortage of qualified drivers, number one, and it’s getting worse each day. Young guys come on board and they think it’s glamorous.

A very Jack Kerouac experience?

Yeah, exactly. And then they find out, “I have to unload all this crap, and it’s heavy.” They’ll do one or two lines, and they’ll quit. The other thing is drivers were driving longer than they should have, and the accident rate was going up, so they put electronic readers in the trucks. Before, it was on your honor with the little log book. So, say I was only supposed to do 1,000 miles, but I needed some money—maybe I would write down 1,000 miles but I really drove 1,500 miles—you can’t do that anymore. The electronic readers tell the company and the government where you’ve been, how far you’ve driven, and when you need to come out off the road.

What are the bright spots or reasons for optimism?

Nothing lasts forever, good or bad. Here’s my Pollyanna [thought]: Consumers, at the end of the day, make or break retail. We have been forced, all of us, to look at our homes through new eyes because we work there, we sleep there, we eat there. And what we’re seeing is that people have been forced to really take a good look at their home furnishings, and they’re seeing the little rip and tear or saying, “I can’t sleep on this bed one more night. This really is ridiculous.”

The bright side is that the more they focus on the home, the more the world is a scary, evil place that could kill you, home truly becomes a safe haven. “You know what? If this is the one place where I’m not going to die, I want it to look good and be comfortable. And if I can’t go on vacation, I’m going to take the $10,000 I was going to spend taking the family to Disneyland and do that room over.” I think that really is a legitimate bright side.

I think it’s made a lot of people rethink the competition—that maybe it wasn’t really the designer down the road or the other shop in town, after all. Airlines were the competition. Family vacations. Luxury handbags. That’s the actual competitor for those dollars that are currently going into the home.

Right—and to put a bow on it, moving forward, what does the industry as a whole have to do? We’ve got to create messaging that makes a recliner as desirable as the new iPhone. It can’t just be wood and fabric—it’s got to tell a story of comfort, security, safety and well-being. The bedding guys realized this a long time ago—they were like, “We sell these white rectangles. How do people know the difference?” And so now, if I buy a certain mattress—

You’re buying a good night’s sleep.

I’m buying a good night’s sleep. I’m going to live longer, look better, I’ll probably be luckier in love—all these crazy things. And you know what? It’s working.

Homepage photo: ©GreenOak/Adobe Stock