In 1721, the Parliament of Great Britain banned an import. Centuries later, we’re still seeing the consequences in The World of Interiors.

What do 18th century trade restrictions have to do with modern magazines? More than you’d think. In the early 1700s, Britain was obsessed with Indian printed cottons—lightweight, colorfast, endlessly patterned textiles that were cheaper and more fashionable than anything domestic mills could create. They were so popular, in fact, that they threatened the country’s wool and silk industries. Those workers protested, and in some cases, women wearing calico prints were attacked in the streets. Parliament responded to the outrage first by limiting imports of Indian cotton chintz, then eventually outlawing them altogether.

With Indian textiles suddenly off-limits, British printers scrambled to fill the void. They began experimenting with glazed cottons and printed linens designed to mimic the look of chintz. These domestic imitations were heavier and less vibrant, but they spread quickly, furnishing country houses with faded florals, bed hangings and draped interiors that would come to define the English look. A protectionist law meant to preserve an industry ended up creating an aesthetic.

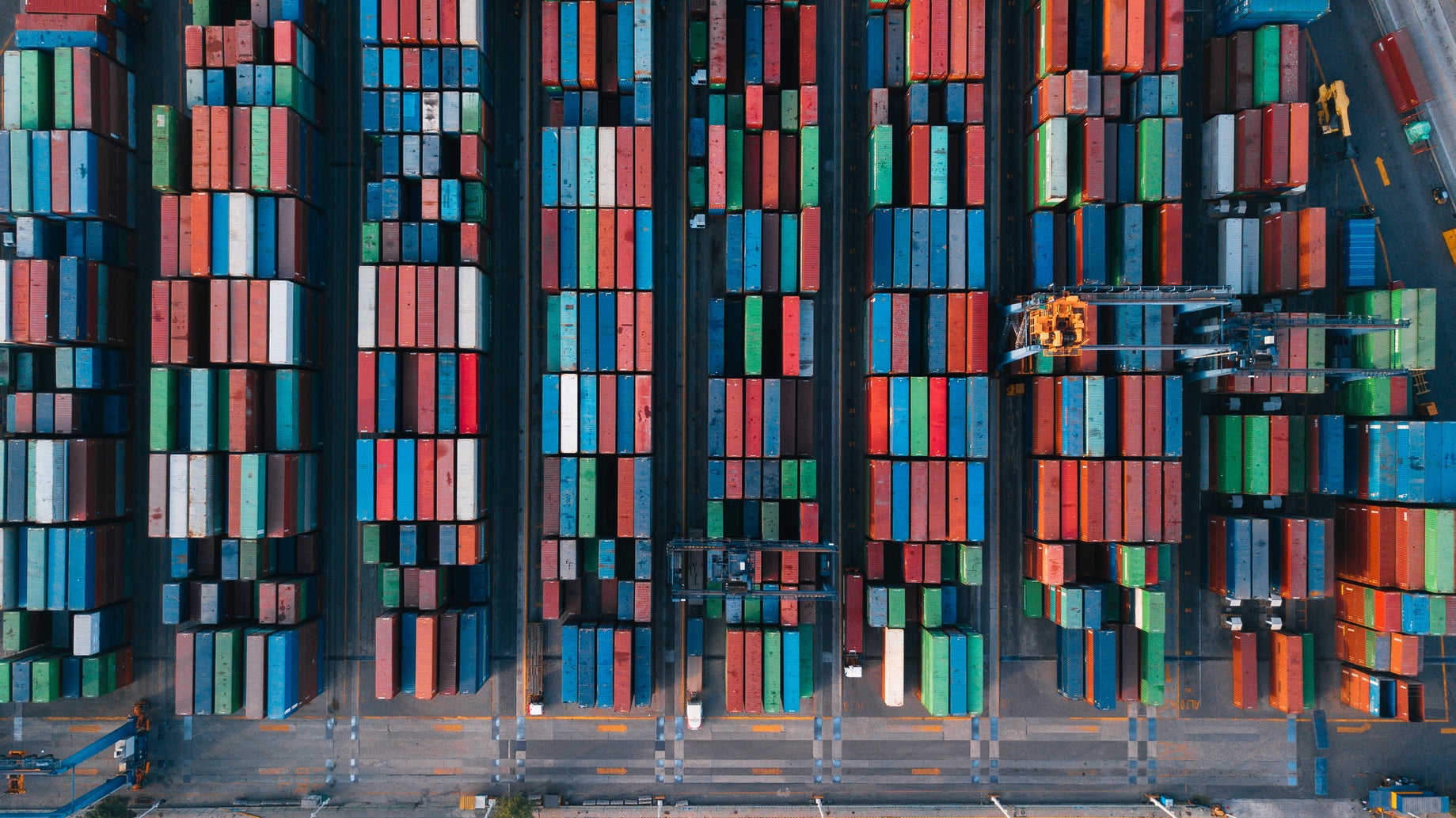

Design history is full of these stories, where big geopolitical shifts, wars, depressions and economic booms leave a fingerprint on aesthetics. The expansions and contractions of European trade with China led to chinoiserie; more recently, World War II–era rationing helped define midcentury modernism; and the OPEC oil embargo against the U.S. in the 1970s, which caused the cost of plastics to spike, pushed manufacturers toward other materials. So it follows that 2025’s wild tariff ride will have some effect as well. We’ve spent the past year speculating about how tariffs will influence how much our homes cost to build and furnish—it’s worth wondering how they’ll make our homes look too.

THE FREEZE

Tariffs are a tax on imports. Figuring out how to deal with them is a tax on importers’ time. For the past eight months, companies that bring in anything from overseas—from fabrics to finished goods—have been playing a frantic game of Whac-A-Mole as President Trump’s trade policy has shifted from week to week.

“Take a piece of furniture that has an [imported] steel component in it. You have to determine the amount of value of the steel component because a 50 percent tariff applies to it. And then let’s say you have a stone part that’s coming from another country—that’s got a 19 percent tariff,” explained Rock House Farm CEO Alex Shuford on a recent episode of The Business of Home Podcast. “When we do the analysis of what the price change should be, we’re taking three or four people in our engineering and costing team and locking them in a room with granola bars and bottled water for three weeks. Those are people that had full-time jobs. They have things they’re supposed to be doing—not just adjusting pricing constantly.”

All of the time spent on the phone with suppliers and buried deep in the minutiae of the harmonized trade schedule is time not spent developing new product. To be clear, High Point Market will still have plenty of introductions next year. But companies that might have developed 100 new SKUs are downgrading to 50, and the general consensus is that now is a time to lean on your bestsellers, not take crazy swings on a new look.

“Companies are really being conservative right now,” says Suren Gopalakrishnan, the co-founder of MakersPalm, an agency that helps brands and designers develop products and supply chains. “The thought is, ‘Let’s do an extension on what works; let’s introduce colorways.’” By stifling the appetite for innovation, tariffs may act as a kind of handbrake on aesthetics, freezing in place styles that might have otherwise been phased out or evolved.

PARING DOWN

Toward the end of September, Trump announced a tariff of 25 percent on upholstery from most countries, which is set to slide up to 30 by the new year. In theory, the duty is supposed to push sourcing to domestic producers, which may or may not happen. Another unintended consequence? In cases where upholstery was optional—on products like counter stools or dining chairs—some companies may opt to eliminate it in order to keep the price down (or just simplify the paperwork).

“An upholstered counter stool used to be a given, but now that upholstery is going to carry a category [tariff] of 30 percent—or even higher if it’s [from] China—those same pieces are now maybe a little bit more elevated,” says Winn Galloway, CEO of Lindye Galloway Studio and its sister furniture brand, Le Maé. “We have counter stools that have upholstered seats—we’re not going to strip them down and change that, but other brands, if they’re looking to engineer toward a price point, they’re going to have to have a loose cushion.”

In general, a paring down of material complexity seems a likely outcome of the tariff era. Steel and aluminum, both heavily tariffed, will show up less if they’re not essential to a design. Products that combine a wide range of finishes and specialized components from all over the world will be simplified to minimize costs.

“If you’re designing out a piece that has aluminum or steel on it, and then it also has upholstery on it and maybe some imported wood—you’ve just put yourself in a position where you might get double or triple tariffed,” says Galloway. “We have to be really mindful about the products we’re developing. We were working on some upholstered ottomans with a steel base, and we have to put that on hold because we’d be layering so many unnecessary costs on our customer.”

Trade and economic forces have the strongest effect on aesthetics when they tie into movements that were already in motion. Jaye Anna Mize, vice president of advisory and partnerships at trend forecasting agency Future Snoops, says that even before Trump’s second term, brands were looking to pull back on the complexity of their offerings.

“A lot of these shifts were already happening,” she says. “Material monotone has been building for a while, [and] brands were simplifying long before tariffs came back into the chat: cleaner silhouettes, tighter material stories, less ornamental layering. Tariffs just nudge the trend along instead of creating it.”

Interestingly, Mize has an optimistic take on what may come of the tariff era. “Historically, anytime the industry has gone through a period of forced constraint, the rebound tends to be smarter, not louder,” she says. “People get thoughtful. The last big slowdown ended up fueling the rise of multifunctional design in 2020 and 2021.”

This time around, the stakes are just as high, and Mize thinks designers will rise to the challenge again. “Constraint breeds invention,” she explains. “When margins get tighter, designers get scrappier. They start asking what actually earns its place. A piece that used to have five materials goes down to two, not because anyone is scared, but because it forces the core idea to stand on its own. In a funny way, it is making design a little more honest.”

SHOP AROUND

In a year filled with curveballs, one of the curviest was a 50 percent tariff on India dropped late in the summer—a shock, given the previously warm relationship the U.S. has shared with the world’s largest democracy. Even now, experts who closely follow the relationship between the two countries say the exorbitant duty was a negotiating tactic, and predict that a more favorable trade deal will be in place by the new year.

Even so, the tariffs were particularly impactful for designers, many of whom were importing rugs and textiles directly from Indian vendors. The new tax was large enough to push them to look elsewhere for rugs, often Nepal, which is currently tariffed at a more palatable 10 percent rate. “It’s been such a moving target,” says San Francisco designer Tineke Triggs. “We’ve gone back to Nepal, and I’m finding the quality to be better. The cost is more, but with a lower tariff it works.”

If the duties hold for longer, expect India’s grip on the carpet and rugs business to loosen, and for a more global palette of sources to show up on American floors. By the same token, techniques and styles that are more or less specific to India—hand-block-printed textiles, for example—may lose some of their presence in the marketplace due to the unexpected price hike.

VINTAGE REVIVAL

The overall effect of the tariffs seems to mostly be about subtraction. The rare example of addition is vintage, especially U.S.-sourced vintage, one of the rare categories that faces virtually no pricing pressure from trade policy. Anecdotally, designers say that clients are more willing than ever to buy old things, at least partially because they feel like a deal at the moment.

There’s some data to back that impression up. In 1stDibs’s most recent trends report, the category was clearly on the rise: Among the designers surveyed, 36 percent of all items they sourced on a given project were vintage or antique, the highest level since 2021. The look of the tariff era will likely feature a heavy dose of the past.

Anthony Barzilay Freund, editorial director of 1stDibs, says that the company’s data shows that tariffs are certainly having an effect on designers who shop on the platform, and that trade policy will likely create subtle shifts in aesthetics. But—a helpful reality check—it won’t matter as much for the one percent of the one percent.

“For many high-visibility interior design projects—the types of homes most of us encounter in shelter magazines and on social media—budgets are fungible and money is no object, especially for objects that are rare, beautiful and come with an international provenance,” he says. “Tariffs may do little to dampen the rarefied appetite for that kind of material.”