High-end furniture and decor brand Kathy Kuo Home has been profitable (and self-funded) since its founding in 2012. In 2019, Kathy Kuo met with investors to explore fundraising that could grow the business even faster—but ultimately decided to pursue a different route.

I first decided to consider fundraising in order to accelerate growth of a specific part of the business—the interior design service, which launched in 2017, had 400 percent growth year-over-year and brought in millions without advertising. We thought, If this is the high-margin piece of the business, why not double down on that growth rate by fundraising to build out the tech?

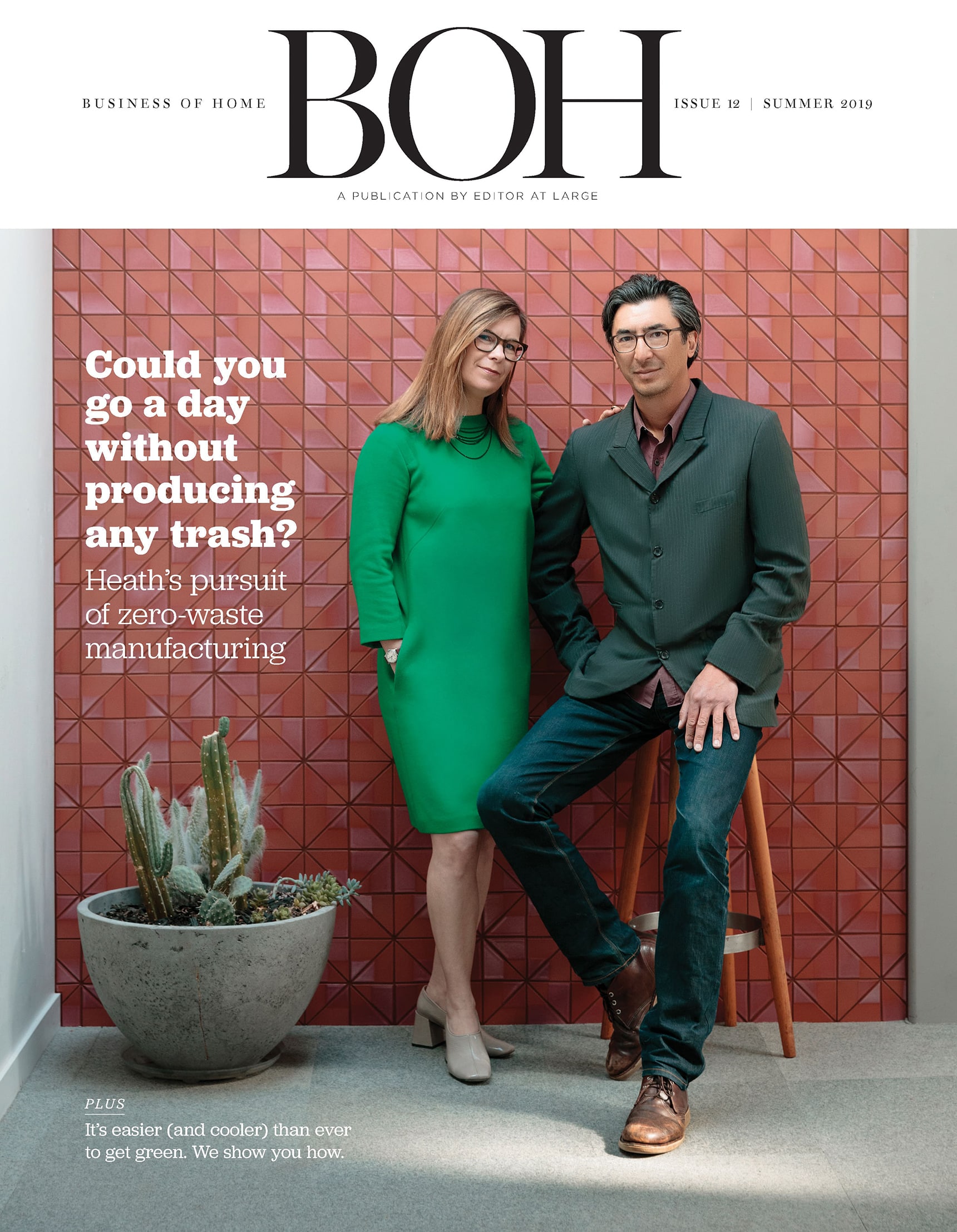

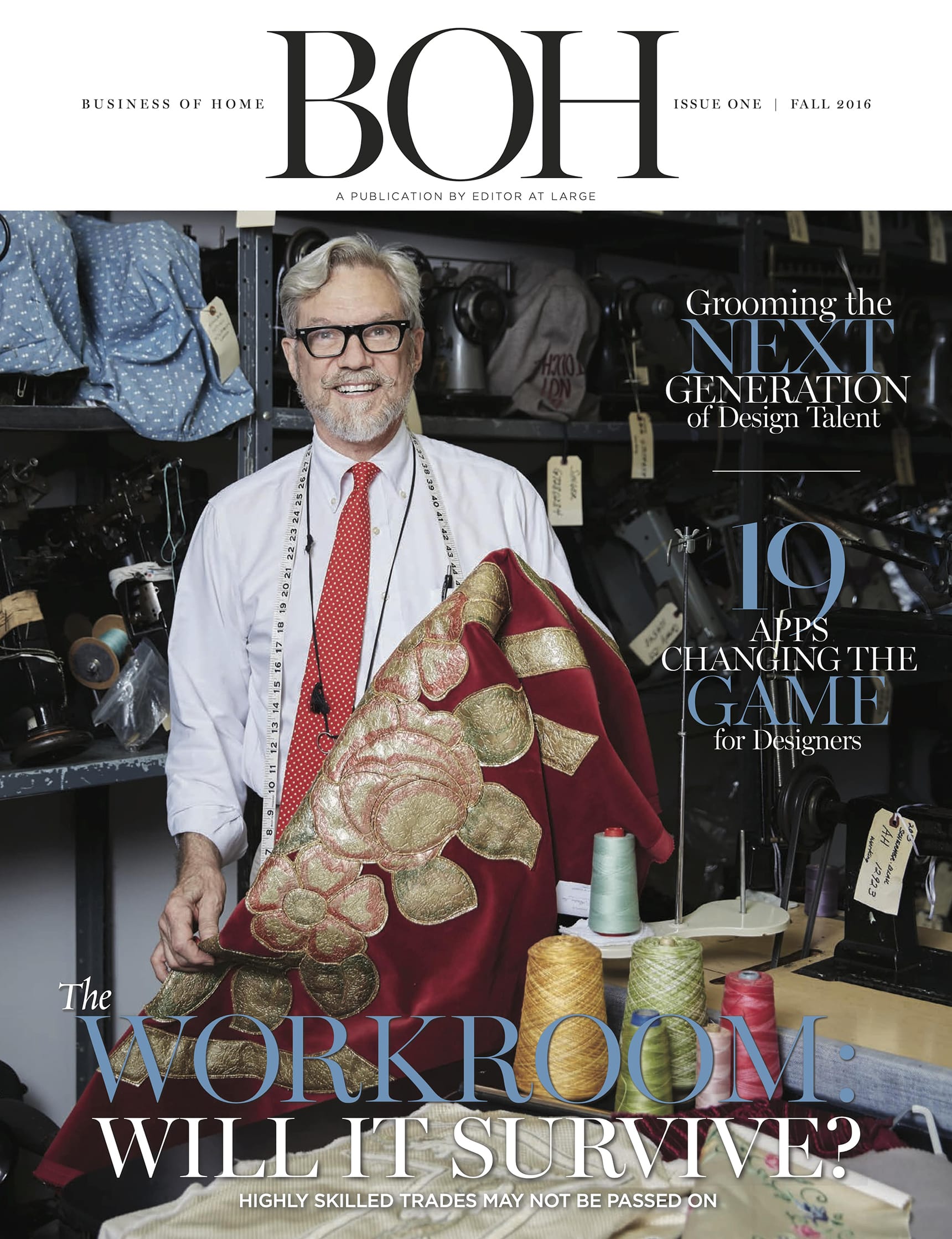

Kathy KuoShannon Ho

Ready to dig in?

This article is available exclusively for

BOH subscribers and BOH Insiders.

BOH subscribers and BOH Insiders.

Want full access?