That’s two acquisitions in two months for Adam Sandow. Fresh off snapping up struggling Canadian design magazine Azure, he has purchased the design product information platform Architonic. Financial terms were not disclosed.

“We continue to be on an acquisition and growth trajectory, [and] where there are opportunities to find great brands, we like to buy,” the Sandow Companies founder and CEO tells Business of Home. “Architonic is one of the longest-serving and largest websites in Europe for architects and designers to search for products. … But it’s more than that. What really attracted me is that it’s a data business, and that’s a business we really like.”

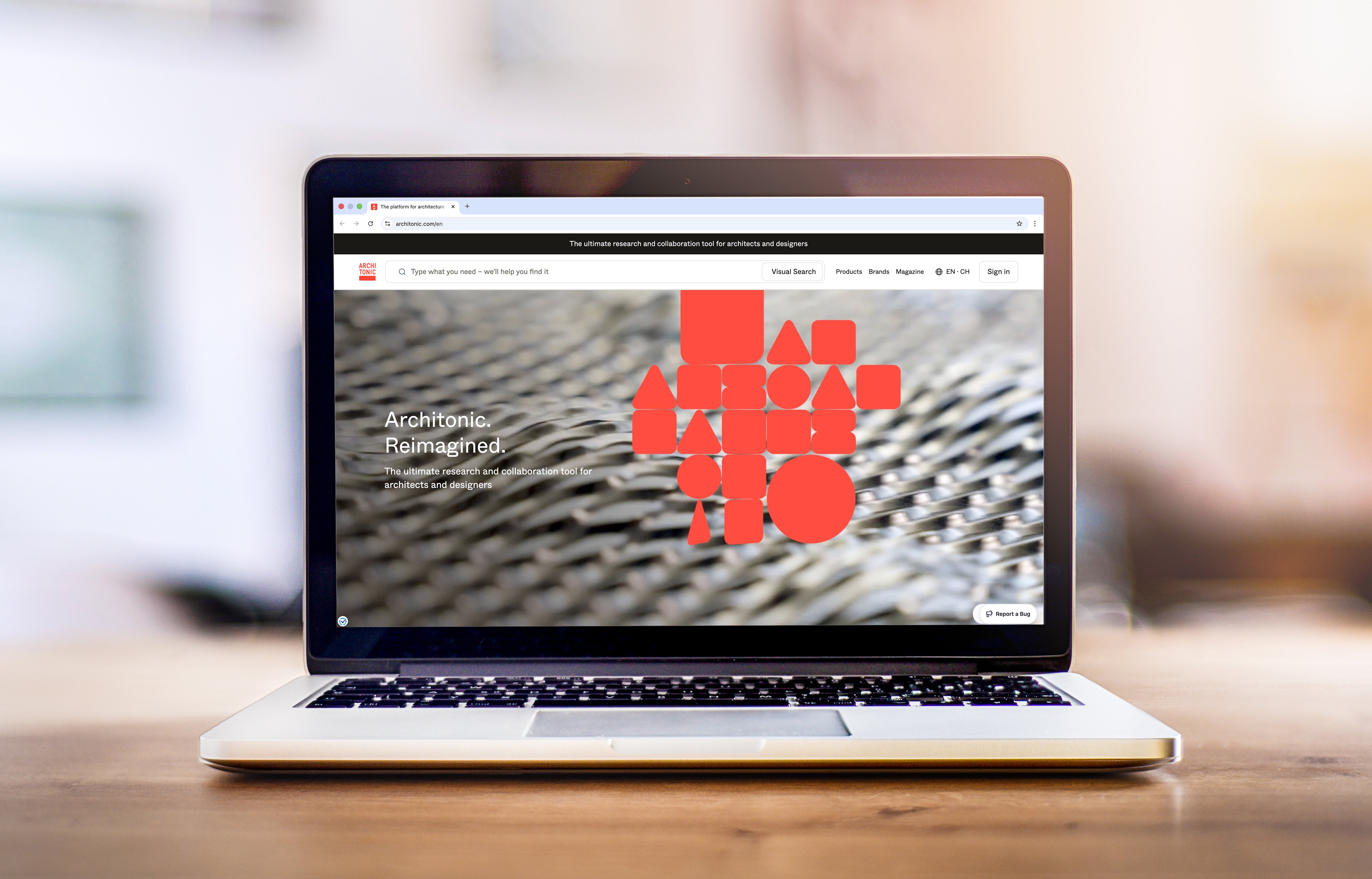

Founded in Zurich in 2003 by a team of architects and IT specialists, Architonic began as an online hub of product information for the design industry. The platform has expanded in scope and capability since then, but the core concept hasn’t changed: Architects, designers and retailers use the site to browse and get specifications on tens of thousands of products, from upholstery to wall sockets. Architonic, in turn, charges brands fees for listing their goods.

In 2015, Swiss news publisher NZZ acquired a stake in Architonic and later purchased media sites ArchDaily and Designboom, merging the three companies into a new group it called DAAily Platforms. Following the transaction with Sandow, the group now consists of the two sites.

Architonic is technically a global platform, but its influence is concentrated in Europe. The company fields roughly 50 employees in Switzerland and Germany. Its website references 16 million annual visitors and 4,000 listed brands, but doesn’t share details about its registered user base. Sandow says the company is profitable.

Though Architonic has some very real similarities with Material Bank, Sandow—who returned to the CEO role there last summer, replacing former Amazon exec Sebastian Gunningham—says that the goal is not to merge the two platforms directly or combine functionalities into a product-specification mega app. However, he is hoping that plugging the company into the broader Sandow network will unlock value.

“We’re inheriting a pretty good sized sales team in Europe; and eventually, will that sales team sell across other brands? Possibly,” he says. “Can [we now] offer American brands getting their product onto Architonic? Sure. If you think about the size and scale of all of the media we own, from Design Milk to Architizer to Interior Design to Luxe, we have hundreds of thousands of architects and designers around the world. It’s the network effect of having critical mass across magazines and websites and social media and events. You cross-pollinate. … It’s about building the scale.”

The move also fits Sandow’s increasingly global ambitions. With Material Bank established in Europe and Japan, the company has significant footholds both across the pond and in Asia. Acquiring Architonic and Azure is part of that expansionist strategy.

“Material Bank has been in Europe for a good two years now. It will grow by 80 percent, 2025 over 2024, so a lot of growth in Europe,” he explains. “As we’re expanding, we’re actively looking at companies to acquire to give us more of a global footprint. Material Bank operates in 37 countries now, and for Sandow, the holding company, we really think that having a global footprint makes sense.”

The deal lands only a week into the new year, and coincidentally comes hot on the heels of the acquisition of one of Architonic’s competitors, Archiproducts, by Italian publishing conglomerate Mondadori. Sandow says more deals may be coming soon, suggesting that 2026 could be a busy time for M&A advisors: “I think we’re going to see a boom this year.”