Europe has always been the mecca of fabric sourcing. But mills located elsewhere are figuring out how to stand out—and at a major discount.

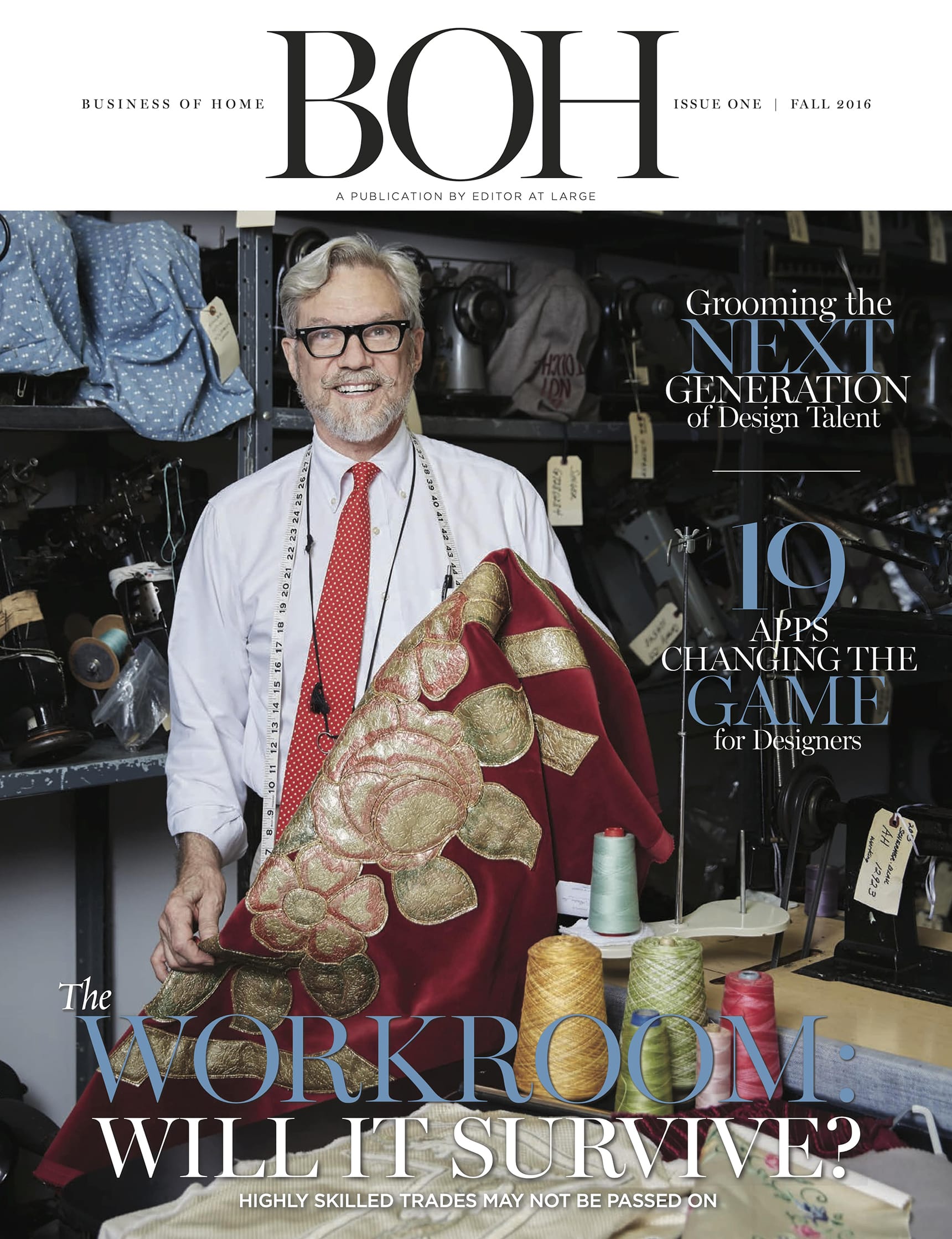

“When we acquired Clarence House in 2003, some of the best product in their line at that time was created in the prodigious, prolific weaving region of Caserta in southern Italy,” recalls Bob Appelbaum, president of the luxury fabric house. “We still source a lot of product there, but over the years, many of those mills have gone out of business.” The story of textiles in Italy is one of extremes: exceptional beauty and extraordinary quality, complicated by the demise of the region’s yarn suppliers, dyers and finishers who have closed up shop, crippled by rising costs. (In addition, a longstanding unfavorable exchange rate with the euro has further crushed the margins of American companies who source in Europe.)

“For us, Italy is the most important country in the world for sourcing,” says Appelbaum. “The mills there are, without a doubt, the most creative.” But manufacturers on other continents have emerged as key players in the textiles trade, including mass-produced, value-oriented fabrics from China, sheers from Turkey, and luxury textiles from India. While Italy may often be Appelbaum’s first stop, it is not his only stop when sourcing—especially for some of the other companies under the Clarence House umbrella.

Nina Butkin, vice president of design at Fabricut, Inc., has witnessed the same shift. For Fabricut’s high-end brands—Vervain, S. Harris and Stroheim—Italy is still an important source; for cost efficiency, the others—Trend and Fabricut—now source primarily in Turkey, India and China. “One of the reasons we still buy from Europe for the luxury brands is because they are so advanced in their design, in the quality, and in that attention to the feel of the fabric, the weaves, the types of fibers and how to use them in innovative ways,” she says. But Butkin also has her eye on a handful of mills in India that are starting to compete with the European market because of investments the factories have made in the people, skills, design development and manufacturing processes—investments that may well render them major competitors in the near future.

BOH subscribers and BOH Insiders.