A new class of online antiques platforms is challenging the status quo and giving designers the power.

April 4, 2016, marked what Benoist F. Drut, managing partner of Maison Gerard in New York City, called “the revolution.” 1stdibs, the site founded by Michael Bruno in 2001 but is now run by David Rosenblatt, initiated a controversial policy. For any sale that began online, 1stdibs would collect a commission, from 10 percent (on purchases up to $10,000) down to four percent (on purchases over $50,000). Ninety-seven percent of the dealers remained on the site, said Cristina Miller, senior vice president of dealer relations at 1stdibs, but a major conversation had started. It’s a story that Silicon Valley knows well: The trailblazer gets the glory of being first; the competitor gets the opportunity to improve. The antiques marketplace has learned a few things, and next-generation platforms like Design Carta, DECASO, InCollect, eBay Collective and RubyLUX are leveraging the feedback loop. Each site is trying to make its mark by offering dealers and buyers new services, including trade-only rates, no commission fees and digital tools for inventory management, as well as more exposure and advertising. Here, we investigate the merits of each platform—get your new usernames ready!

On November 1, 2016, Bruno debuted Design Carta. The trade-only website launched with nearly 300 dealers. One point of distinction: Buyers must also qualify as members of the design trade, to keep the community vetted. Dealers list their wares at no charge until March of this year, when a monthly fee of $250 for unlimited listings goes into effect. Inventory can be maintained on the site for as long as sellers desire; however, there is a two-week exclusivity requirement, which means all listings on Design Carta can’t be posted on any other platform until the exclusivity period has passed. This is meant to keep inventory unique.

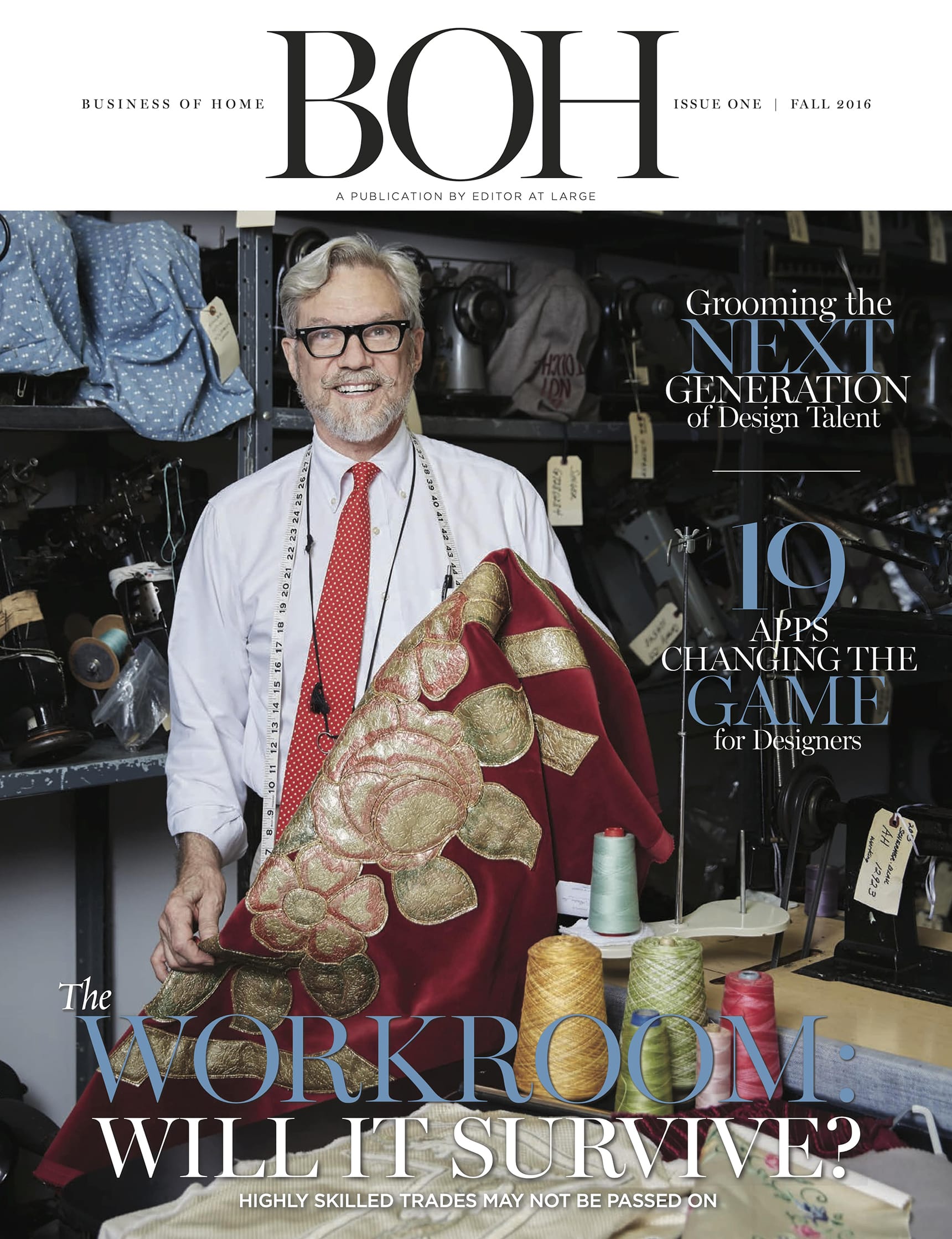

BOH subscribers and BOH Insiders.