If you could sum up all of the conventional business advice of the past decade in three words, it would probably sound something like: Get online, now. As digital adoption has increased exponentially in every corner of our lives, it’s generally been a good bet for any company—from fashion houses to donut chains—to figure out how to sell their product to more people on the internet. So it was more than a little surprising when Fabricut CEO David Finer sent out an announcement last week that his company would pull out from online retail platforms en masse, effective March 1.

“We are making this decision in what we feel is in the strategic interest of our company,” wrote Finer. “Decisions such as this are not easy or comprehensively popular. We will be speaking with many of you in the coming days and weeks.” The announcement covered all of the Tulsa, Oklahoma–based fabric giant’s brands, from S. Harris and Vervain to Fabricut’s eponymous line—all told, thousands of fabrics, yanked offline in one fell swoop.

In a booming era for e-commerce, Fabricut is packing up its bags, bidding goodbye to retail consumers and going home. Why?

To understand the brand’s rationale, it’s worth diving into the complex and occasionally murky world of online fabric sales.

Today, it’s a source of heated argument in the design industry whether or not trade-centric brands should sell their products directly to consumers online. On one side are the manufacturers, who don’t want to miss out on sales; on the other are designers, who are often seeking exclusive access (and pricing) to products they sell to clients. What that conversation sometimes ignores is that, in the world of fabric, the debate was mostly settled more than a decade ago, when designer-turned-entrepreneur Barbara Karpf founded Decorators Best and began retailing designer fabric online.

At first, brands were hesitant to participate with the platform. Karpf launched in 2004 with only two fabric houses, but quickly demonstrated there was a significant market of consumers who wanted to buy high-end fabric online. More brands began selling through her site, and more sites got in on the action. Today, there’s a whole landscape of online retailers—from independent players like Decorators Best and L.A. Design Concepts on up to massive tech platforms like the Wayfair-owned Perigold—where brands like Kravet, Schumacher, Scalamandré (and, for a few more weeks, Fabricut) peddle their wares.

Though the sites are targeted to end users, there are concessions to the trade. Brands often delay sending new releases to online retailers, which gives designers a window of exclusivity. Many also enforce a MAP (minimum advertised price) higher than designer pricing, allowing for a margin. But whatever arrangement each brand makes with its partners, for the biggest players in fabric, selling through online retail—once a taboo—is now common.

This arrangement is good for the retailers themselves (obviously), and it’s good for consumers, who get easy access to high-quality product. It’s also presumably good for fabric brands, who generate extra cash and give their lines a second life in a new market. For designers—well, it’s complicated.

Online fabric retailers cut into two key advantages long held by designers: exclusivity and pricing power. Historically, designers could tell their clients they alone had access to the finest product in the world—a value proposition that’s less and less true as commerce migrates online. More important is the price issue. When online retailers list a fabric at a per-yard cost anyone can see, it places pressure on designers who charge a margin on goods, especially if their standard markup puts the cost of the fabric above what the client would pay if they were shopping themselves.

It’s precisely that awkwardness that Finer hopes to eliminate with this move. By pulling all of Fabricut’s fabric from online retailers, he’s reinstating the company’s brands as walled gardens once again, accessible only to designers through reps and showrooms. In doing so, Finer will lose out on a source of revenue. But the move may generate enough goodwill among his customers to make up for those losses, or even exceed them. It’s a bet, essentially, that designers will reward Fabricut’s loyalty in kind: We’ll stick with the trade, you stick with us.

“I’m laying down a marker to say we have to try to create some sanctity of pricing so the interior designer doesn’t feel trespassed on when they're trying to finish a deal after investment of time, money and travel. They’re aggravated when they can be undersold like that,” Finer tells Business of Home. “I think the loss will be [offset] by loyalty. And I have various statements of this case in point, designers who say: ‘I’m going to use you now because I can’t be shopped online.’”

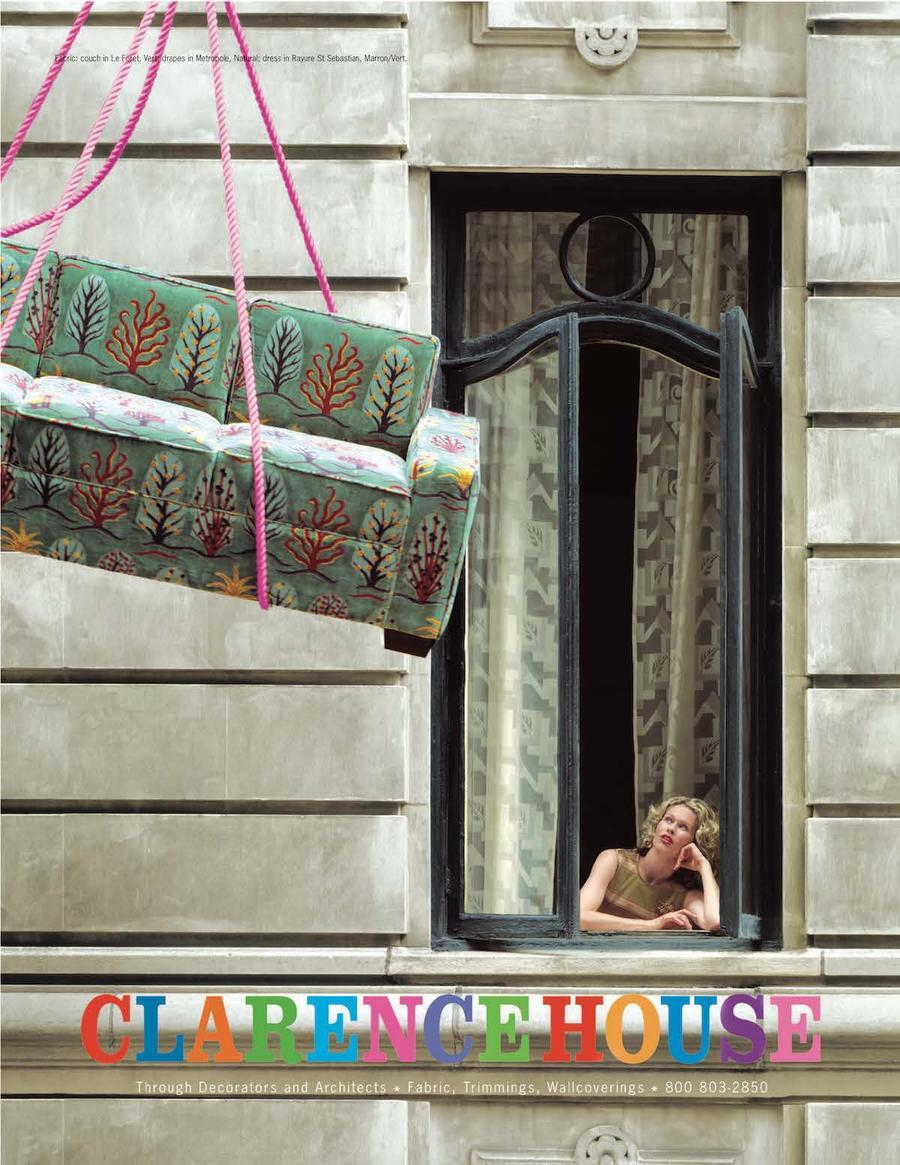

While the implementation of these changes is coming fast, the decision was a long time coming. In 2019, Fabricut purchased Clarence House—the venerable brand founded in 1961 by Robin Roberts—from textile supplier P/Kaufmann, which had owned the company since 2003. As part of an effort to revitalize the brand and refocus on a designer clientele, Fabricut pulled Clarence House from online retailers. It was an experiment that cost the company a sizable stream of revenue; at the time of the announcement, Fabricut vice president David Klaristenfeld told BOH that Clarence House pulled in $150,000 to $200,000 annually in retail sales.

Three years later, Finer says the boutique brand has grown around 25 percent through traditional distribution, a number that convinced him what was good for Clarence House would be good for the rest of his portfolio. The move “really pleased all of the partners who sell Clarence House, and we had overwhelmingly good vibes from the community,” says Finer. “In the subsequent two years, we had this bubbling up of frustration from interior designers that being shopped online was counterproductive to their efforts. It wasn’t episodic, it was chronic, so we decided to move all the brands that we control offline.”

However, taking Fabricut’s entire selection offline is an order of magnitude more consequential than cutting Clarence House alone. Clarence House was already a high-end, designer-focused brand at a price point out of reach for many retail consumers. The rest of Fabricut’s portfolio, meanwhile, includes a range of lines, from the more value-oriented (Trend) to luxurious, archive-inspired damasks (Vervain). Each has its own unique perception within the trade, and its own potential for retail sales. Simply put: It meant a lot to designers to get exclusive access to Clarence House, and less to consumers to lose it. That particular calculation is different for each of Fabricut’s brands.

This move is also far more complicated. Fabricut owns Clarence House’s patterns exclusively, and could pull the brand offline unilaterally. However, spread out across its entire portfolio of brands, roughly 60 percent of Fabricut’s fabrics are licensed from converters—who themselves now sell through online retailers in some cases. So while Fabricut can pull its entire stock offline, there’s no guarantee that converters themselves won’t sell the same product directly to the public at a lower price.

That conundrum is a broader structural issue in the fabric business—many other brands of Fabricut’s size are in a similar position. Finer says he’s working to combat this by having “serious” conversations with converters, pressuring them not to undercut brands on pricing, or to pull their stock offline. “It’s an unfair competition, essentially,” he says.

How much is at stake in this all-in bet on designer loyalty? Finer declined to give a specific number, but says online retail sales make up a single-digit percentage of his company’s revenue. That sounds small in theory, but for a brand the size of Fabricut, it’s not a stretch to guess it represents hundreds of thousands of dollars in revenue that will suddenly dry up on March 1.

It’s worth noting, too, that online retail of fabric seems to be growing, not shrinking. Karpf, the founder of Decorators Best, says the pandemic home boom had the same effect on her business as so many others in the industry, and some of the brands on her platform saw up to 150 percent growth in sales over the past two years. “We’ve felt the effects since the very beginning of [COVID],” she tells BOH. “First, having stores closed compounded with the accelerated interest in home … we were there to fill that right away. The business has exploded.”

Further complicating the picture is the fact that online retail sites have begun selling to designers as well as consumers. Decorators Best recently introduced a trade program that Karpf says grew rapidly during the pandemic, as design centers everywhere shut their doors or limited their visitors, and designers looked for ways to shop multiple brands online. Increasingly, the open borders of the internet make it difficult to divide up a consumer base into neat segments.

And though other fabric brands have likely heard the same stories of designers getting shopped online as Finer has, thus far they’re all staying put on the platforms. Kravet, Scalamandré, Quadrille and dozens of others continue to list at least some of their product through retail channels online. While speaking with BOH, Karpf mentioned offhand that she recently signed the Zoffany family of brands to her platform. Fabricut is the first time a line has ever voluntarily left Decorators Best.

“More than ever e-commerce has become a staple of American life, brands are very familiar with it and they realize how important it is to their overall sales—to give you an idea, since the pandemic, with the partners who we’ve worked with very closely, we’ve grown to become not only their individual largest account, but we’re probably their largest customer,” says Karpf. “I want to be able to do that for all of our brands.”

Clearly, brands see opportunity in retail sales. Many would contend that selling a few yards of fabric to homeowners here and there doesn’t compete directly with designers’ businesses, and that the steps they’ve taken—pushing for minimum pricing for retailers and walling off some SKUs as trade-only—create protections for the trade that make sense for the digital age. “We haven’t had a brand call us with a complaint from a designer in eight years,” says Karpf. “And it turned out the complaint wasn’t even about our website.”

Brands must also take into account the fact that the way interior designers charge is in a state of flux. (“If you talk to 10 designers today, you’ll hear 10 different ways of charging,” jokes Karpf.) Adjusting to the radical transparency of the internet, some are experimenting with pricing structures that place less of an emphasis on markups and more on hourly and design fees. While markups are certainly nowhere close to disappearing, many trade brands have clearly bet that they’ll get smaller, and matter less, in the future.

All to say, though the change returns Fabricut to a more “traditional” way of doing business, in the present climate it’s something of an unconventional play. But to hear Finer tell it, it’s simple common sense. It keeps his core customers happy, it moves his brands away from the stigma of heavy discounting (many online retailers lure consumers with sales), and it keeps pricing simple. And shifting norms or no, he argues, designers will always appreciate a margin.

“I want some propriety. I want my customers to take our products, use them with confidence and not worry about what's behind them all the time,” he says. “There’s a whole metamorphosis in how the trade deals with consumers, but at the end of the day the trade has overhead and they're going to spend time and money trying to do the best job for a client using that overhead. They deserve to make some margin for their services, and that’s what we’re trying to assist in.”

Thus far, the public reaction to the move has been positive. When Clarence House pulled out of online retail, many designers took to Instagram to cheer the brand’s efforts; last week’s news brought a similar flurry of kudos on social media. “The letter that I sent caused many designers to come out of the woodwork with their own stories of travail—it was pent up,” says Finer. “I’ve heard from many of them who have appreciated the decision.”

Whether that goodwill will end up on Fabricut’s balance sheet—only time will tell.

Homepage photo: Courtesy of Fabricut